The Saudi Arabian property market has moved beyond simple trading; it is now a regulated, high-stakes investment landscape defined by rapid infrastructure growth and shifting legal frameworks. Whether you are capitalizing on the 2026 Foreign Ownership Law, securing headquarters for the RHQ Program, or liquidating family assets, you need representation that understands the technicalities of the transaction.

We provide a full-service brokerage model that bridges the gap between regulatory compliance and commercial success. We don’t just “list properties” we manage capital allocation and asset disposition with the precision of a financial consultancy, fully aligned with the goals of Saudi Vision 2030.

Buying property in KSA requires a filter for quality and legality. The market is saturated with listings, but high-yield assets and legally clean titles require thorough due diligence.

We move faster than the portals. While we utilize major platforms, our primary value lies in our network of developers and private sellers, giving you access to inventory before it hits the open market.

Focusing on high-demand districts. In Riyadh, we target the northern growth corridor (Al-Arid, Al-Malqa) where infrastructure upgrades are driving capital appreciation. In Jeddah, we focus on Al-Safa and Al-Naeem for consistent rental demand.

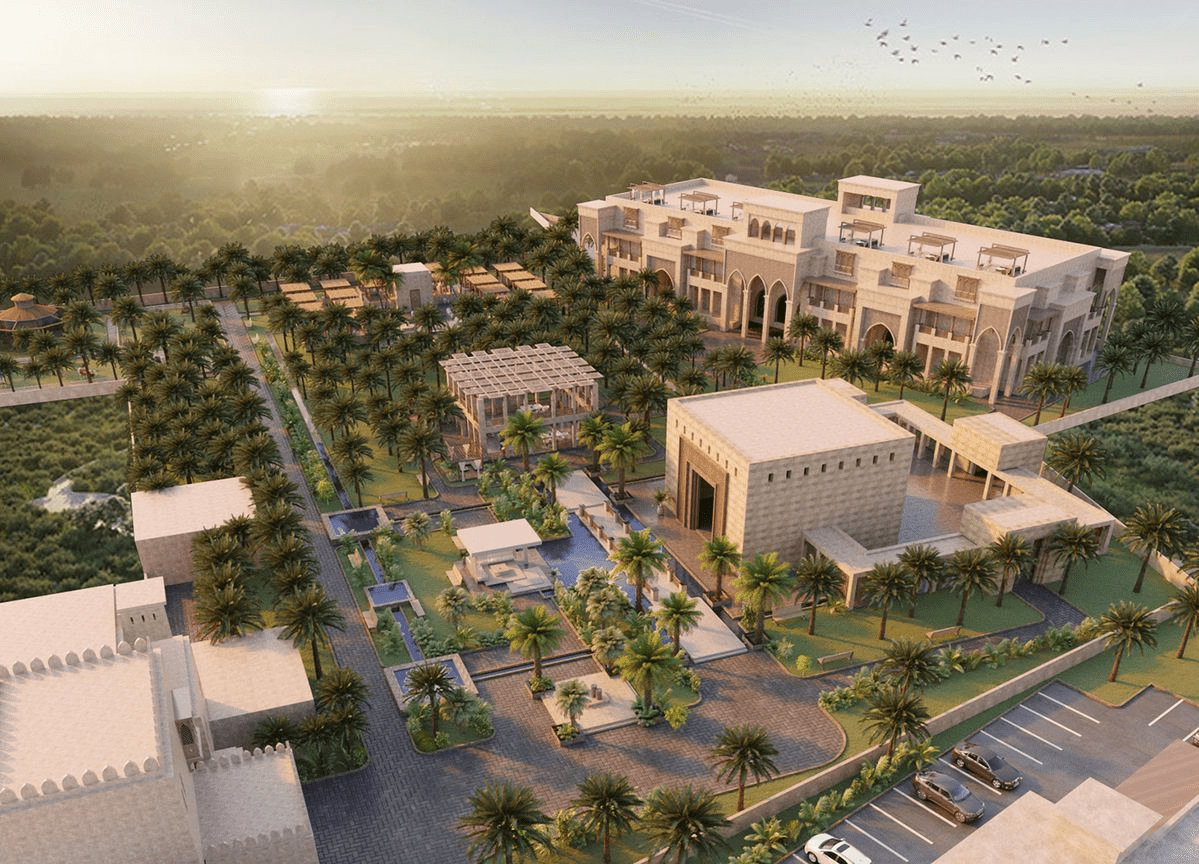

Sourcing Grade-A office space and retail units compliant with the new Saudi Building Code, essential for international firms establishing regional bases.

Overpaying is the biggest risk in a rising market. We employ Taqeem-accredited valuation standards to determine fair market value, ignoring inflated asking prices.

For investors, we calculate net yields (after maintenance and management fees), specifically looking at the 6-8% yield benchmarks common in performing residential assets.

We only recommend projects registered with Wafi, ensuring your down payments are protected in escrow and the developer has a track record of delivery.

We issue the mandatory electronic brokerage contract required to market your property.

We obtain the specific "Fal" advertisement license for your property, ensuring your listing remains live on all platforms without legal interruption.

We optimize listing descriptions for high-volume keywords like "Villas for sale in Riyadh North" or "Commercial land Jeddah," capturing buyers at the decision-making phase.

Professional staging and photography are standard. For luxury assets, we deploy video tours that answer the "remote viewing" needs of international investors.

We push listings through a mix of portal dominance (paying for premium placement) and targeted social media campaigns (LinkedIn for commercial, Snapchat/Instagram for residential).

We guide foreign nationals and entities on where they can buy. While Makkah and Madinah remain restricted (leasehold only), the new law opens up freehold ownership in Riyadh, Jeddah, and the Eastern Province for residential and commercial purposes.

We advise on property acquisitions that meet the threshold for Premium Residency (Gold/Green Visa). You can verify current investment thresholds and eligibility via Invest Saudi.

We assist in structuring purchases to be efficient regarding the Real Estate Transaction Tax (RETT) and advising on repatriation of funds after a future sale.

We sign a brokerage agreement outlining fees (capped at 2.5% by law) and deliverables.

We advise on property acquisitions that meet the threshold for Premium Residency (Gold/Green Visa). You can verify current investment thresholds and eligibility via Invest Saudi.

We draft the "Offer to Purchase," securing commitment with a deposit.

We draft the "Offer to Purchase," securing commitment with a deposit.

We facilitate the final title transfer at the Ministry of Justice or through an accredited notarizer, ensuring the RETT is paid and the deed is transferred instantly.

The new "Law of Real Estate Ownership by Non-Saudis" is scheduled to take full effect in January 2026. It aims to simplify the process for non-Saudis to own real estate in approved zones.

RETT is a 5% tax levied on the total value of a real estate disposal (sale). It applies to most transfers of ownership and must be settled before the title deed can be transferred. It replaced the 15% VAT on property sales to stimulate the market.

Yes, but strict due diligence is required. You should only buy projects that are approved by Wafi (the off-plan sales and rent committee). Wafi ensures your payments go into an escrow account and are released to the developer only as construction milestones are met.

As an owner, you can sell your property directly. However, if you use a marketer or broker, they must hold a valid Fal license from the Real Estate General Authority. Using unlicensed brokers puts you at risk of fines and invalid contracts.